wisconsin auto lease sales tax

1 800 452-3328 Wisconsin residents only or 608 264-7969. You will have to pay insurance premiums.

Arizona Motor Vehicle Bill Of Sale Form Download The Free Printable Basic Bill Of Sale Blank Form Template In Micros Bill Of Sale Template Sales Template Bills

Sales Taxes and Leasing.

. 1 Dealer A sells a motor vehicle to Individual B and accepts the trade-in of two motor vehicles owned by Individual B. This would be the payment with sales taxes included meaning that 4413 per month was sales tax for this particular payment. Jun 27 2022.

55167 x 108 59580. For questions or to register for training email the dealer training team at dealertrainingdotwigov. Please include your dealer name and the names of those attending.

Where such charges are separately set forth upon the invoice given by the seller to the purchaser. International registration plan IRP or International fuel tax agreement IFTA Wisconsin Department of Transportation. An interesting twist on the taxability of rentals and leases can arise with equipment that is provided with an operator.

The average Wisconsin car sales tax including state and county rates is 5481. The math would be the following. Tax 1184 2 a1.

Buying out your BMW lease could be an option for ownership. Some states do not impose tax on leases or rentals of equipment if the equipment is provided with an operator. States except New Hampshire Alaska and Oregon and Canada impose a sales tax often called a use tax on motor vehicle purchases by consumers.

Form RUT-50 Private Party Vehicle Use Tax Transaction Return due no later than 30 days after the purchase date of the vehicle. To learn more see a full list of taxable and tax-exempt items in Wisconsin. In these cases the state considers the charge to be for a service and not for the lease or rental of property.

The sales price received from the following shall be taxable. The Dealer and Agent Section DAS is now offering a voluntary dealer training seminar to interested dealer owners and their representatives. Motor Vehicle Lease Dealers - Trade-Ins and Turn-Ins.

The sale license lease or rental of aircraft by any retailer registered or required to be registered to collect Wisconsin sales or use tax regardless of whether the retailer is. Form RUT-25-LSE Use Tax Return for Lease Transactions due no later than 30 days after the date the vehicle is brought into Illinois or the date of lease. Used and new cars have the same sales tax in Wisconsinthe statewide base sales tax rate of 5 plus your local or county tax rate.

The values of the two motor vehicles traded in by Individual Bare 8000 and 9000. While Wisconsins sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The sales price subject to sales tax is 3000 the 20000 selling price less the 8000.

If you end the lease early you may have to pay substantial early termination charges. In the case of leasing the lease finance company passes the sales tax along to you the lessee even though the lease company is the actual owner of the vehicle. 2009-10 provides an exemption from Wisconsin sales and use taxes for charges for insurance.

Form ST-556 Sales Tax Transaction Return due no. The selling price of the new vehicle is 20000. The other is the sale or lease of the.

What You Need to Know. This page describes the taxability of leases and rentals in Wisconsin including motor vehicles and tangible media property. Lease Payment Before Taxes x 1 State Sales Tax The 1 represents 100 percent of the payment.

Wisconsin Department of Revenue. And sales tax on the monthly payments.

Https Bohoot Blogspot Com 2021 02 Property Sale Agreement Sample Pakistan Html Agreement Property For Sale Contract Agreement

Rentals Leases How Does Sales Tax Apply To Them Sales Tax Institute

Trade In Sales Tax Savings Calculator Find The Best Car Price

New And Used 2022 Ford F 150 Raptor For Sale Near Me Cars Com

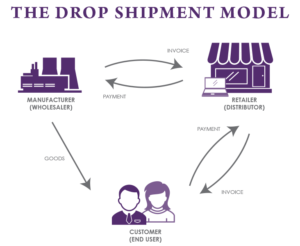

How Do Drop Shipments Work For Sales Tax Purposes Sales Tax Institute

Wyoming Child Support Computation Form Net Income Calculation Form Child Support Supportive Net Income

8125 8201 Hickman Mills Dr Kansas City Mo 64132 Kansas City City Country Club Plaza

Trade In Sales Tax Savings Calculator Find The Best Car Price

Apartment Rent Receipt How To Create An Apartment Rent Receipt Download This Apartment Rent Receipt Template Now Receipt Template Being A Landlord Rent

How Do Drop Shipments Work For Sales Tax Purposes Sales Tax Institute

Should Your Employees Be Salaried Or Hourly Employee Salary Business Advice

Rentals Leases How Does Sales Tax Apply To Them Sales Tax Institute

Pin On Kenmore Akron Ohio Barberton Ohio

Vintage Shots From Days Gone By Page 3639 The H A M B Old Gas Stations Vintage Gas Pumps Old Gas Pumps

How Do Drop Shipments Work For Sales Tax Purposes Sales Tax Institute

Tuscarawas Street Cars Barberton Ohio Postcard Barberton Ohio Barberton Youngstown Ohio

Pin By Blake Avery On Idaho Falls Yesteryear Idaho Falls Street View Idaho

The Boulder Group Arranges Sale Of Net Leased 7 Eleven Property Denver News Bouldering Property